pay past due excise tax chicopee massachusetts

Determining Tax Increase or Decrease Whether the tax rate for the community will increase or decrease from the prior year will depend upon the levy decided upon by the community and whether property values appreciate depreciate or. You must pay the excise within 30 days of receiving the bill.

WE DO NOT ACCEPT CREDITDEBIT CARDS AT ANY OF OUR WALK-IN LOCATIONS.

. Excise taxes are billed annually and are due 30 days from the date of issue. Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. Annual return and payment 10000 or less Due annually on or before the 30 th day following the year represented by the return.

Interest 12 per year from due date to payment date and. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. Find your bill using your license number and date of birth.

Massachusetts Motor Vehicle Excise Tax Information. Demand bills will be issued for any excise bill not paid by the due date. The deadline for filing an abatement application is clearly printed on the tax bill.

Sales and Use. Pay my past due excise tax massachusetts. A 10 demand fee will be charged to each bill.

For more information visit New Due Date for Sales and Use Tax Returns Due on or before the 30th day following the quarter represented by the return. You must pay the excise within 30 days of receiving the bill. Please note all online payments will have a 45 processing fee added to your total due.

THIS FEE IS NON-REFUNDABLE. Massachusetts motor vehicle excise tax information. On the 31st day interest will begin to accrue at 14 retroactive to the bill date.

Pay Past Due Excise Tax Bills. If not paid pursuant to massachusetts general law chapter 60 section 15 a demand fee of 1000 will be added. Pay past due excise tax massachusetts.

Date of Birth. See reviews photos directions phone numbers and more for Pay Excise Taxes locations in Chicopee MA. 2018 excise tax commitments unless past due.

Payment is due within 30 days of the bill date not the postmark. Excise tax bills are owed to the citytown where the vehicletrailer was garaged as of January 1. Tax Department Call DOR Contact Tax Department at 617 887-6367.

Once the amount to be raised is determined a tax rate is calculated by dividing the amount to be raised by the total valuation of the city or town. Pay Past Due Excise Tax Bills. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

You can reach them at 508 543-1216. Chicopee Collectors Office 274 Front Street Chicopee MA 01013 Online Payments We accept online payments for. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

If that vehicle had. Chicopee City Hall 17 Springfield Street Chicopee MA 01013 Phone. Sending a demand for payment of the excise Set locally up to 30.

Chapter 60A of Massachusetts General Law imposes an excise tax for the privilege of registering a motor vehicle or a trailer in the Commonwealth of Massachusetts. The place of garaging of the vehicle as of January 1st determines the city or town to which the bill is payable. Bills are assessed on a calendar basis.

Massachusetts motor vehicle excise tax information. You must make payment in cash money order or cashiers check to have the mark removed immediately. The excise rate as set by statute is 25 per thousand dollars of valuation.

The excise is based on information furnished on the application for registration of the motor vehicle. Call the Taxpayer Referral and Assistance Center at 617-635-4287. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill.

This information will lead you to The State. To make a Payment By Phone 247 please call toll-free 877-415-6045. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality.

The City of Melrose does not assign the value to the vehicle this is done by the Registry of Motor Vehicles. Motor vehicle excise bills only for on-time payments. To Mail a Payment Mail a check or money order along with the payment stub using the envelope provided or to.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Overvaluation appeals are due within 30 days of the bill date. This information will lead you to The State.

M-F 9am - 5pm Directions. Drivers License Number Do not enter vehicle plate numbers spaces or dashes. The tax bill represents 12 of the full years tax.

Pay my past due excise tax massachusetts. 64I and the Departments sales tax regulation on. Chicopee City Hall 17 Springfield Street Chicopee MA 01013 Phone.

Interest at a rate of 12 per annum will be charged from the due date to the date of payment. If you are unable to find your bill try searching by bill type. Pay Excise Tax in Chicopee MA.

If you do not fully pay a motor vehicle excise on or before its due date you also have to pay. Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. Massachusetts Motor Vehicle Excise Tax Information.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. If you do not fully pay a motor vehicle excise on or before its due date you also have to pay. 2018 excise tax commitments unless past due.

FLAGGED bills will take up to 1. If you dont have a. The value of a motor vehicle is determined by the Commissioner of Revenue based on the manufacturers list price MSRP.

Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089 9 am4 pm Monday through Friday. They also have multiple locations you can pay including.

Excise Tax What It Is How It S Calculated

Massachusetts 2020 Tax Litigation Summary

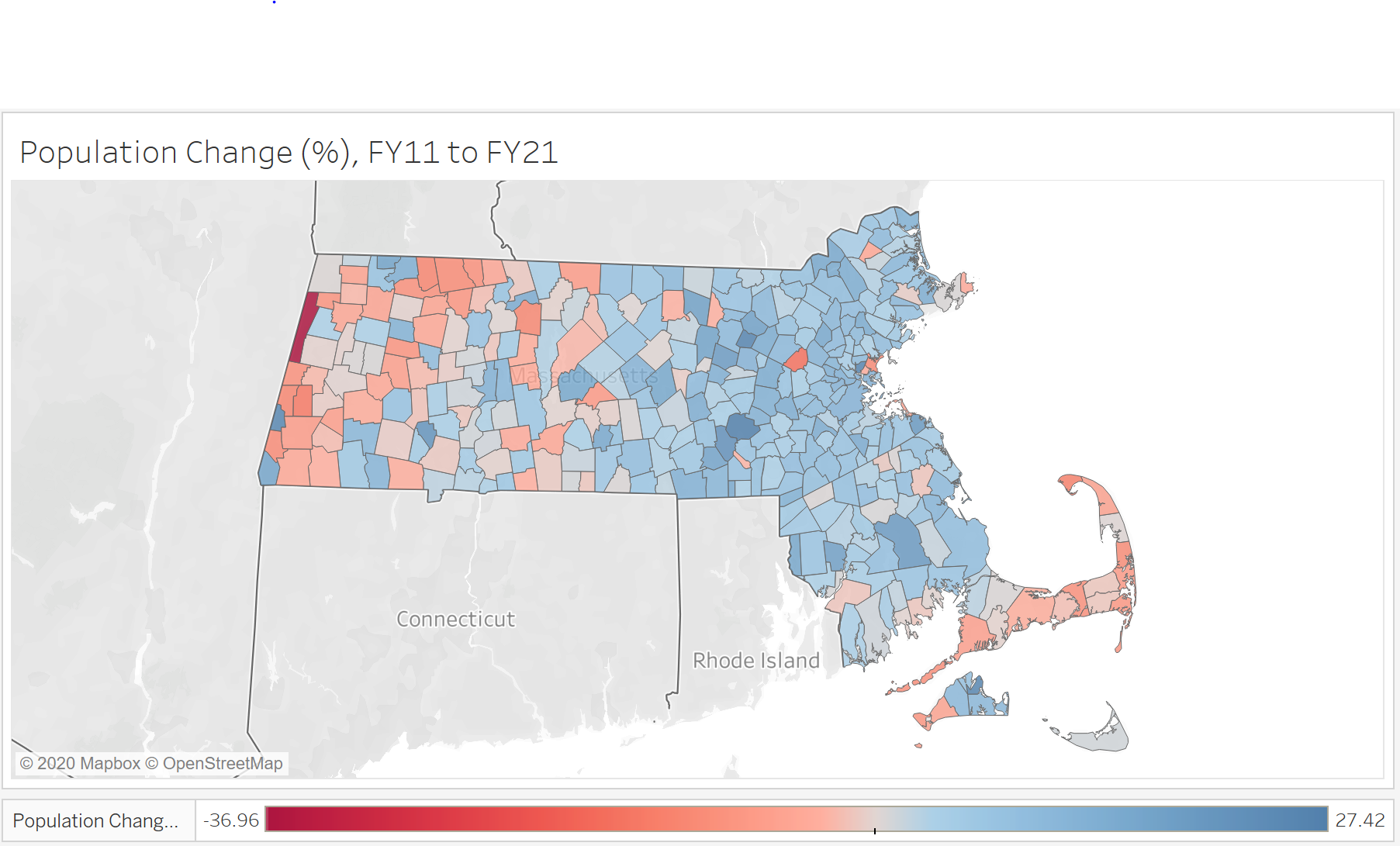

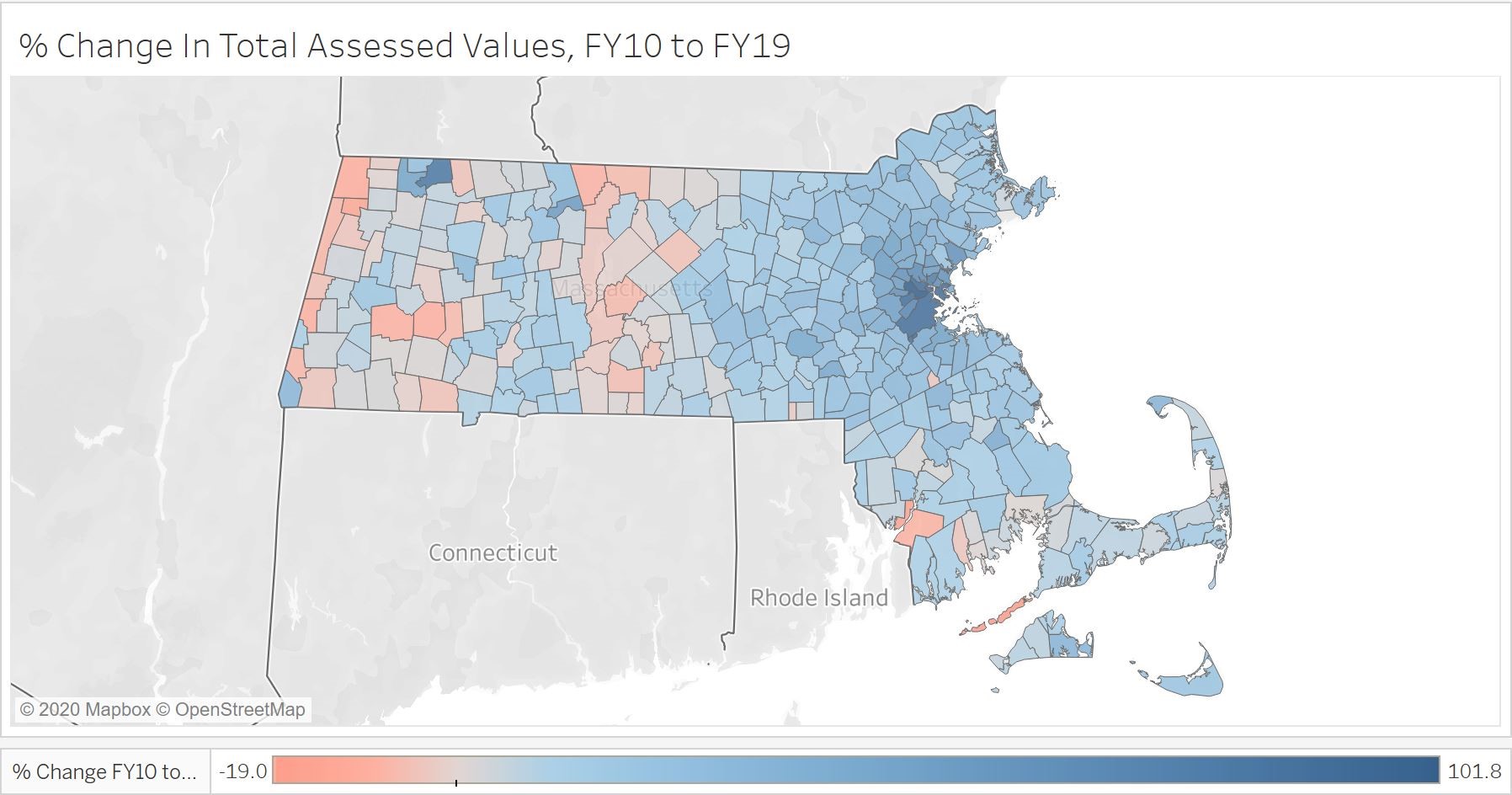

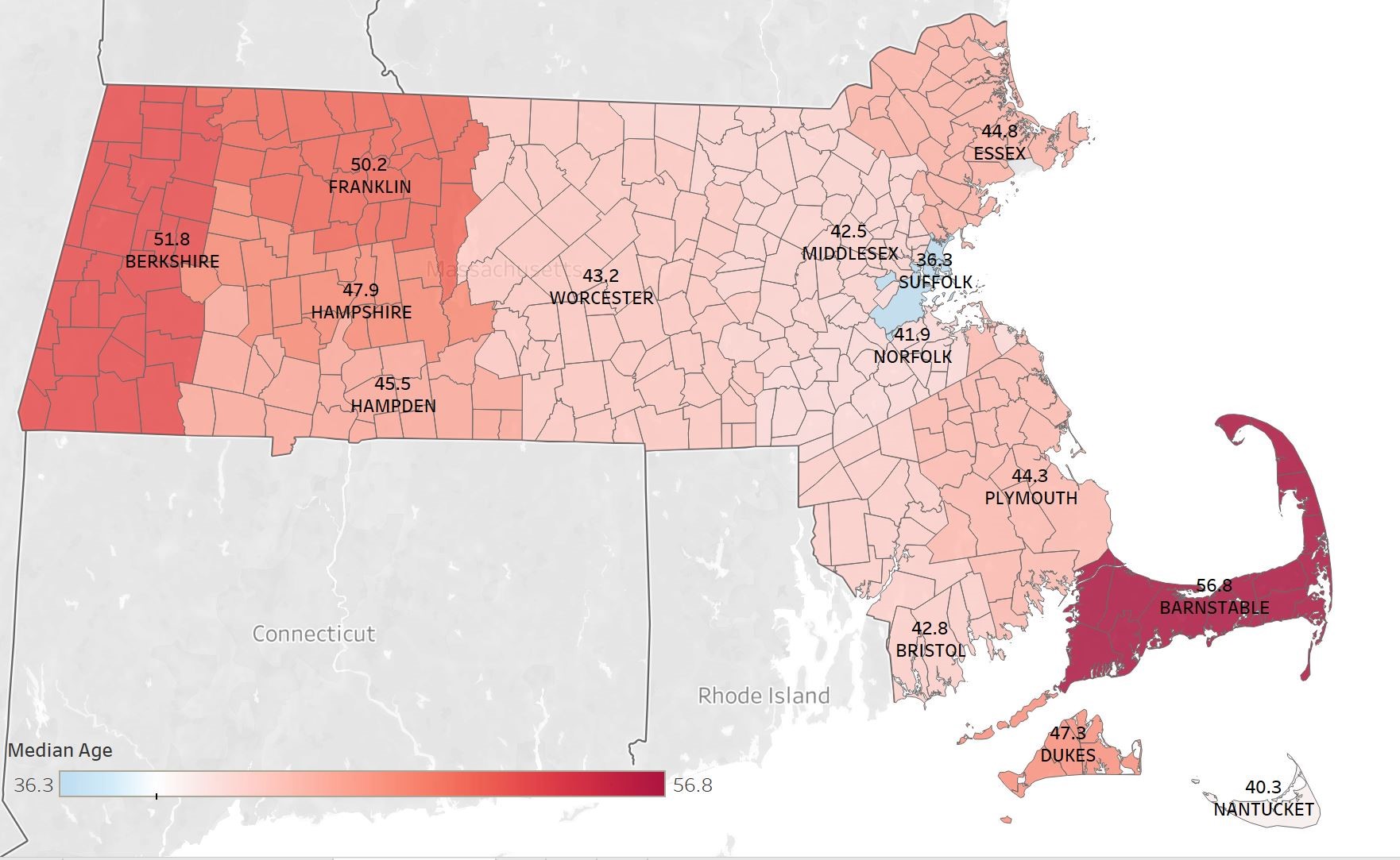

Situational Analysis Of Public Infrastructure In Western Massachusetts Mass Gov

Gmc Tc7500 2007 In Chicopee West Springfield Holyoke Ludlow Ma Matts Auto Mall Llc 416279

Massachusetts Recreational Consumer Council And Theory Wellness Partner To Host Expungement Event At Dispensary In Chicopee Ma Cannabis Business Times

Neighborhood Economic Recovery Fund Cdbg Disaster Recovery City Of Springfield Ma

Situational Analysis Of Public Infrastructure In Western Massachusetts Mass Gov

Burkhart Pizzanelli Bppc1986 Twitter

Chicopee Gives Preliminary Approvals To New 15 Million Cannabis Cultivation Business Masslive Com

Massachusetts Recreational Consumer Council And Theory Wellness Partner To Host Expungement Event At Dispensary In Chicopee Ma Cannabis Business Times

Situational Analysis Of Public Infrastructure In Western Massachusetts Mass Gov