vermont sales tax calculator

One of a suite of free online calculators provided by the team at iCalculator. Vermont is listed in Kiplingers 2011 10 Tax-Unfriendly States for Retirees.

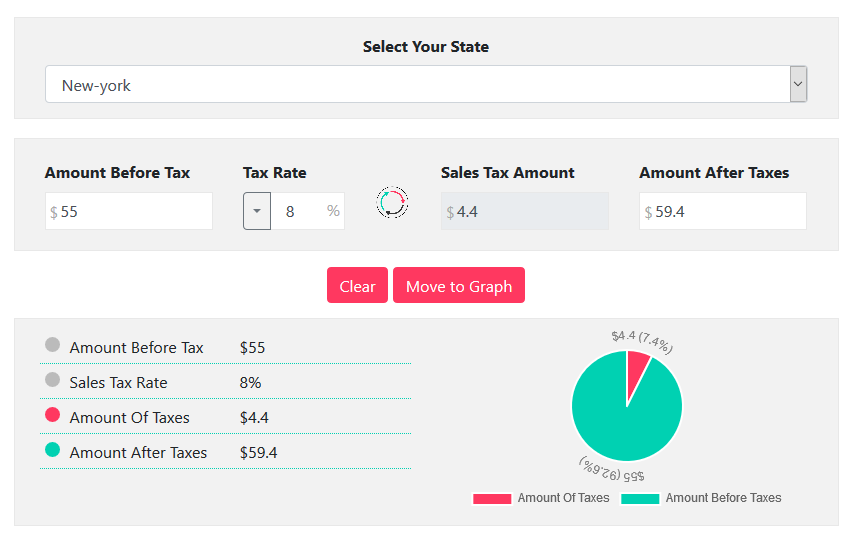

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

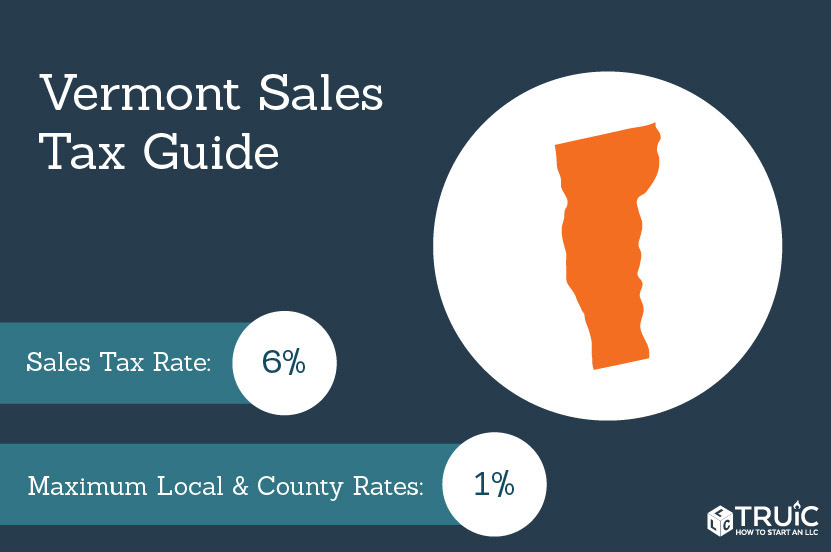

The base state sales tax rate in Vermont is 6.

. Vermont has 19 special sales tax jurisdictions. The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxationYou are required to select the type of ownership of your vehicle at the time you register in Vermont learn about the types of vehicle ownership and when this designation. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Learn about the regulations for paying taxes and titling motor vehicles. How 2022 Sales taxes are calculated for zip code 05733. These are only several examples of.

You are able to use our Vermont State Tax Calculator to calculate your total tax costs in the tax year 202122. Credit will be given for the purchase and use or sales tax paid on this vehicle to another jurisdiction. This calculator is designed to give a simplified answer regarding the taxes you may owe based on the inputs you provided regarding capital gain s and losses.

2020 IN-152 Underpayment Adjustment Calculator. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Vermont local counties cities and special taxation districts. Total CostPrice including ST.

These fees are separate from. Find your Vermont combined state and local tax rate. If the tax paid on an out-of-state registered vehicle was equal to or more than the Vermont tax rate no additional tax will be due.

Integrate Vertex seamlessly to the systems you already use. Taxes on alcoholic beverages in Vermont vary depending on the type of beverage. The 05733 Brandon Vermont general sales tax rate is 7.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. Before-tax price sale tax rate and final or after-tax price.

You can use our Vermont Sales Tax Calculator to look up sales tax rates in Vermont by address zip code. Vermonts tax rates are among the highest in the country. The combined rate used in this calculator 6 is the result of the Vermont state rate 6.

Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. This is the total of state county and city sales tax rates. The Vernon sales tax rate is 0.

The Vermont sales tax rate is currently 6. Tue 02162021 - 1200. The combined rate used in this calculator 7 is the result of the Vermont state rate 6 the Brandon tax rate 1.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Underpayment of 2020 Estimated Individual Income Tax. State taxes are not considered in the calculation.

The sales tax rate is 6. Vermont has a 6 statewide sales tax rate but also has 205 local. How 2022 Sales taxes are calculated for zip code 05250.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return these results. To know what the current sales tax rate applies in your state ie.

The sales tax rate for Middlebury was updated for the 2020 tax year this is the current sales tax rate we are using in the Middlebury Vermont Sales Tax Comparison Calculator for 202223. Choose the Sales Tax Rate from the drop-down list. The tax will be calculated by the dealerleasing company.

Average DMV fees in Vermont on a new-car purchase add up to 70 1 which includes the title registration and plate fees shown above. Tax Year 2020 State of Vermont Annualized Income Installment Method. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. The minimum combined 2022 sales tax rate for Vernon Vermont is 6. Did South Dakota v.

See how we can help improve your knowledge of Math Physics Tax Engineering. The Vermont Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Vermont. The state tax on regular gasoline totals 1210 cents per gallon and the state tax on diesel fuel is 28 cents per gallon.

Vermont sales tax has numerous local taxing levels that must be monitored and maintained on a regular basis it is complex and time consuming due to the volume of jurisdictions. Vermont Sales Tax Calculator. The County sales tax rate is 0.

If this rate has been updated locally please contact us and we will update the sales tax rate for Middlebury Vermont. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates. Enter the Amount you want to enquire about.

There are four tax brackets that vary based on income level and filing status. Please consult a tax professional for specific information regarding your individual situation. Mon 02082021 - 1200.

The 05250 Arlington Vermont general sales tax rate is 6. The state sales tax rate in Vermont is 6. Vermont has a 6 general sales tax but an additional 10 tax is added to purchases of alcoholic drinks that are immediately consumed.

2019 Annualized VEP Calculator. While gasoline purchases in Vermont are not subject to sales tax there is an excise tax on fuel in Vermont. Capital gains rates are subject to.

2021 Property Tax Credit Calculator. Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7. Wayfair Inc affect Vermont.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Check your local Vermont sales tax rates using the TaxJar sales tax calculator. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

Vermont Documentation Fees. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Vermont all you need is the simple calculator given above.

Fri 02192021 - 1200. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax.

The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers.

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Vt State Tax Calculator Community Tax

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Vermont Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

New York Sales Tax Calculator Reverse Sales Dremployee

Vermont Sales Tax Rates By City County 2022

Vermont Income Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Origin Based And Destination Based Sales Tax Rate Taxjar